Sticker shock after college begins is common. Students focus so much on the challenge of being accepted that, once they are, it’s tough to fully understand how much it will cost to finish the degree. And the bottom line is college is expensive. And it won’t be long until you’re in college and wondering what are the best ways to save for college so you can save money on your overall tuition costs. General tuition costs and estimates are not valuable because a college financial aid package is unique to the student. Even with those financial aid numbers in hand, there are still other factors that make the cost comparison difficult. Some of these factors include the following:

- time constraints to select a school

- hidden fees and costs

- variable aid depending on your credit or GPA status

However, just because you’ve already started college doesn’t mean it’s too late to save money. So…what can you do if you’re already enrolled in a college and want to reduce the cost of earning your degree? If you’re already enrolled in school, here are the three ways you could save money for college to lessen the amount you’ll owe for your education.

Skip Taking the Class

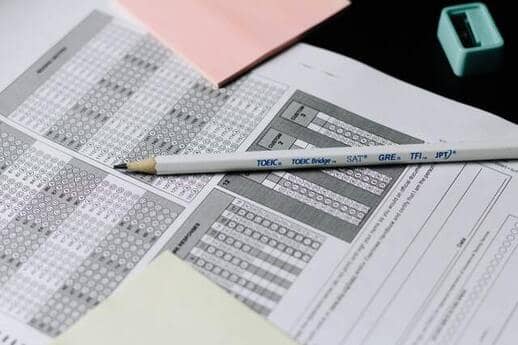

Accredited colleges and universities offer some form of credit for national tests. These tests include SAT II Subject tests, CLEP tests, and exams local to your university’s department. Typically, these tests are for lower-level coursework, such as general requirements. A college or university has a representative in the administration department that can explain the tests and scores the school accepts and which classes the credits replace. Tests do carry a cost, but it’s usually less expensive than the credit hour prices of taking the class.

Another way to earn college credit without taking the class is to challenge a course. This requires a demonstration of knowledge in the areas a course covers. While most universities do require you to pay for these credit hours, a student with leftover financial aid one semester can actually save money on college by completing extra credit hours through a challenge. How? By graduating earlier and entering the workforce ahead of schedule.

Ask for Professional Credit

Most, if not all, universities and colleges offer credit for professional experience and accomplishments. Examples would include managerial experience, technical experience, and accolades within an industry. Now, this credit doesn’t always replace specific course requirements as a test can. It can, however, count as general credit hours. These can get you closer to the total number of credits needed for a degree or certificate. At some universities, there are specific courses considered satisfactory based on specific professional experiences such as military or civic service training. In that situation, the requirement for a specific course is satisfied, but a grade is not awarded toward GPA calculation.

Ask for Reimbursement from an Employer

Many employers offer tuition reimbursement or assistance for their employees going to college while also still working. Requirements of these programs do vary, from the number of hours worked per week to registering for reimbursement before you take the class. There’s a myth that employers will only reimburse for certain majors or degree programs, but that’s not always true. Even if a chosen degree program is not a great fit for upward mobility in a current job, you can try to make minor course studies match. You should be able to have a few courses submitted for reimbursement. Nearly all tuition reimbursement programs require grade submittal for the coursework and pay on completion of the credit hours.

Takeaway

There are many ways to decrease the costs of a degree by pursuing alternative credits or by taking advantage of an employer’s tuition programs. Visit the college’s financial aid office to find the resources needed for these programs and any others a school may offer. Financial aid advisors want to help a student find ways to pay for school before the situation is dire. Already enrolled and knee-deep in earning a degree, it’s not too late for a student to find ways to save money for college on those tuition costs.